Trump's Tariffs Hit: Market Reels, Recession Fears Rise

Uncertainty surrounding President Donald Trump's planned "liberation day" tariffs on April 2nd sent shockwaves through the U.S. stock market on Monday. The market experienced significant volatility following Goldman Sachs' upward revision of its recession probability within the next year from 20% to 35%, directly citing the impending tariffs as a contributing factor.

This heightened anxiety reflects a broader escalation of recession fears on Wall Street. Experts warn that the wide-ranging nature of the proposed tariffs poses a substantial risk of pushing the U.S. economy into a recession. The concern stems from the potential for decreased business activity due to increased tax burdens, and a simultaneous drop in consumer spending as individuals save more to cushion against rising prices and a possible economic downturn.

The exact scope and duration of the upcoming tariffs remain undisclosed, fueling further economic uncertainty. Economist Kara Reynolds of American University highlighted the potential for a negative feedback loop: "If both businesses and consumers start to worry and pull back their spending, that is what can tip the U.S. over into a recession." Mark Zandi, chief economist at Moody’s Analytics, similarly described the April 2nd tariffs as "the fodder for an economic downturn."

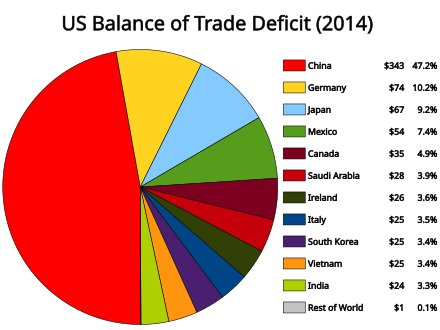

President Trump has already implemented numerous tariffs targeting specific sectors, including autos, steel, and aluminum, as well as imposing levies on goods from Mexico, Canada, and China. He recently indicated that the next round of tariffs could impact "all the countries," claiming they will be "far more generous than those countries were to us." While the Trump administration has largely refrained from explicitly acknowledging the recession possibility, the President previously suggested that a "little disturbance" might be necessary to bolster domestic production and manufacturing jobs.

Economists point to several potential mechanisms by which the tariffs could negatively impact the economy. Higher import costs are likely to be passed on to consumers through increased prices, potentially reducing business competitiveness and leading to customer attrition. This, in turn, could result in decreased business investment, further hindering economic growth. The mere anticipation of these tariffs has already contributed to a decline in consumer confidence, dropping to its lowest level since 2021 in March, according to The Conference Board. Consumer spending, representing roughly two-thirds of U.S. economic activity, is especially vulnerable. Harvard University professor Jeffrey Frankel noted the current "chaos and uncertainty around the tariff policy" impacting consumer confidence.

Despite these concerns, some key economic indicators remain positive, including robust hiring and a historically low unemployment rate. Inflation, while higher than the Federal Reserve's target of 2%, is below its 2022 peak. However, experts emphasize that the policy uncertainty surrounding the tariffs presents a significant risk to the economy's continued stability.